DDD Stock Price: 3D Systems Should Regain Its Upwards Momentum

![]() Naman Shukla is an Analyst at I Know First. He writes and invests in the stock market. Ranked in the top 8 percentile in TipRanks.com. Featured on SeekingAlpha.com, GuruFocus.com, Valuewalk.com among others.

Naman Shukla is an Analyst at I Know First. He writes and invests in the stock market. Ranked in the top 8 percentile in TipRanks.com. Featured on SeekingAlpha.com, GuruFocus.com, Valuewalk.com among others.

DDD Stock Price

Summary

- 3D Systems’ Q1 results were not terrific, but the company should perform better in the future.

- Shutting down the consumer segment will boost margins.

- Arrival of an experienced CEO will help the company in the long run

- I Know First Algorithm is currently bullish on DDD stock movement

After having two back to back troublesome years, it looks like 3D printing stocks, 3D Systems (DDD) in particular, have bottomed. In fact, 3D Systems bottomed a few months ago. The stock has jumped over 100% from its year to date lows, and with sales finally stabilizing, there’s nowhere for the stock to go but up.

Strong growth prospect despite weak results

2015 was not a good year for 3D Systems as the comp any lost more than half of its value. In the most recent quarter, despite the frail environment, the company somehow managed to share earnings per share of $0.05, in-line with the consensus estimate. The company’s revenue came in at $152.60 million, $3.7 million less than the analyst estimate.

Although 3D Systems has pulled back considerably from its year to date highs due to bad results, I think the pullback is an opportunity for investors and traders alike.

The termination of the costumer products promoted gross profit margin which surged to approximately 51 percent in the first quarter. 3D Systems’ operating expenses were $94.3, comprising $20.3 million for research and development division, and $74 million fir SG&A expenses. Furthermore, the company produced $18.1 million in cash from operations as well as $13.9 million free cash flow.

Moving on from the negatives, there were a few bright spots in 3D Systems’ Q1 report. Regardless of the adverse influence of feeble printer sales, revenue generated from materials escalated 4 percent, mainly because of greater orders from industrial consumers.

3D Systems’ management anticipates that the company’s launch of new printers and its prevailing product quality along with partner advantages will aid fortify its position in the printer segment. At present, it is not possible to calculate the number of possibly lost consumers due to termination of the consumer division of the additive manufacturing market, but it is predicted that sales of consumer 3D printers will surge swiftly and reach 900,000 units till the last quarter of 2017. If 3D Systems fails to reach that target, it will not have a major impact on the company, apart from a small inevitable profit in the consumer segment.

Apart from these, 3D Systems has placed its emphasis on the industrial sector which will certainly reap profits in the form of a lesser cost of sales. And the most significant thing is the arrival of the new CEO, Vyomesh Joshi, who has worked as executive vice president for Hewlett-Packard Company’s Imaging and Printing Group. Joshi’s experience of 32-years may be exactly what 3D Systems needs to sustain its upwards momentum.

Intensifying competition

Competition is gradually rising in the desktop market. 3D Systems’ foremost rival Stratasys (SSYS) has been moving forward with the help of MarketBot desktop printer unit, which it took on board for $403 million in 2013. In the meantime, 3D Systems discontinued the manufacturing of its $999 Cube desktop printer in the month of December 2015.

In addition, competition is also rising in industrial division as robust growth and industry hype bring in new players and influx of cash from venture capitalists. According to a report from Wohlers, 62 firms sold industrial type additive manufacturing systems priced at more than $5,000 previous year, a surge of 13 firms compared to that in 2014. Moreover, Hewlett Packard strategies to enter in the race this year by launching 3D printers using an exclusive inkjet process termed Multi Jet Fusion.

However, things have been better for 3D Systems mainly because of Q4 results. Poor demand still survives in many segment of the market, but business adoption of 3D printing/additive manufacturing is still escalating at a strong rate.

With time, many companies are entering in the 3D printing sector, and are mainly placing its focus on industrial and professional market similar to the Stratasys and 3D Systems. This might create many problems for the company if the company does not introduce a more effective product as compared to its rivals. However, new CEO Joshi is well aware of this kind of situations, and knows how to effectively drive operational performance. Thus, I believe investors betting on the stock should feel confident about the company going forward.

Conclusion

An effective CEO can make massive difference and with the sector slowly stabilizing, I think 3D Systems has got their man to take the company forward. With the stock still beaten down, I think the risk-to-reward ratio is in the favour of the longs. Hence, I think investors and traders both can consider buying the stock.

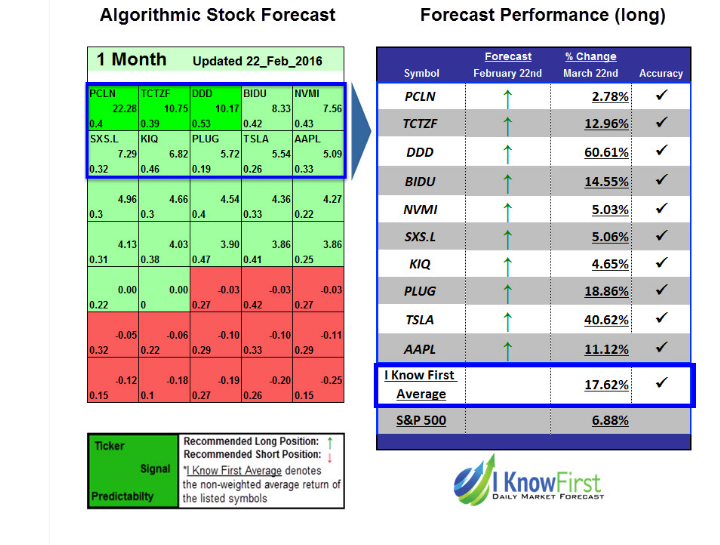

My bullish stance on DDD is echoed by I Know First’s algorithmic forecasts. I Know First uses an advanced state of the art algorithm based on artificial intelligence and machine learning to foresee market performance for more than 3,000 markets including stock forecasts, world indices, commodities, interest rates, ETFs, and currencies. The algorithm generates a forecast with a signal and a predictability indicator. The signal is the number at the center of the box. The predictability is the figure at the bottom of the box. At the top, a particular asset is identified. This format is standardized across all forecasts. The middle number indicates strength and direction, not a price target or percentage gain/loss. The bottom figure, the predictability, signifies a confidence level.

As you can see from the above image, the green 144.47, 311.93 and 1736.17 shows that I Know First’s bullish signal for 3D Systems is strong in the short term and very strong in the long-term, which resonates with my outlook as well.

I Know First Algorithm accurately predicted in the past the bullish DDD stock movement, shown in the DDD stock forecast below, from February 19th.

With a bullish signal of 10.17 and a predictability of 0.53, achieving a return of 60.61% in the period of 1 month.